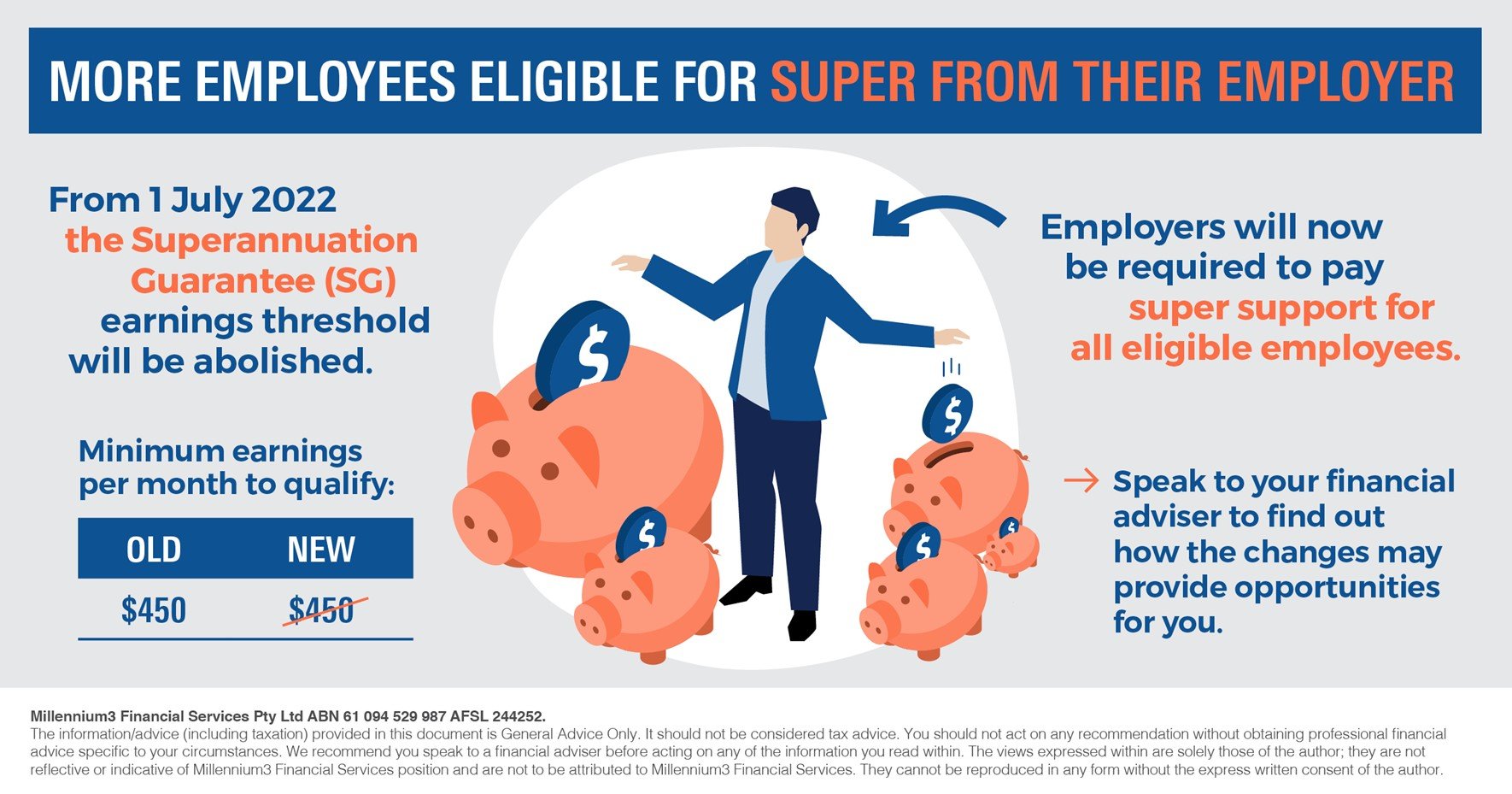

Superannuation Guarantee (SG) requires employer to pay a minimum level of super support for eligible employees. One criteria for an employee to be eligible is based on that employee’s monthly earnings being at least $450 per month. However, this threshold is abolished from 1 July 2022.

This measure primarily assists low-income earners to have employer contributions paid to super boosting their retirement savings.

SG contributions count towards your concessional contribution cap and should be taken into consideration when determining any other contributions made.

Business owners should review their processes to ensure that SG is paid for all eligible employees. Penalties may apply if SG is unpaid or paid late. Further information on SG can be found by visiting ato.gov.au

WHAT NEXT?

Speak to the friendly staff at Addept for more information on the changes and how it may impact or provide opportunities for you. Further general information can also be found on the ATO website.

Disclaimer: The views expressed in this publication are solely those of the author; they are not reflective or indicative of Millennium3 Financial Services position and are not to be attributed to Millennium3 Financial Services. They cannot be reproduced in any form without the express written consent of the author.

The information provided in this document, including any tax information, is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial situation or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.