Investors are well and truly jumping back into the property market. Nationally, the value of new investor loans increased by 0.7% in June compared to the value of new owner- occupier loans, which dropped by 2.5%. Compared to this time last year, owner-occupier loans are up by 75.9%, but investor loans are up by 102%.^

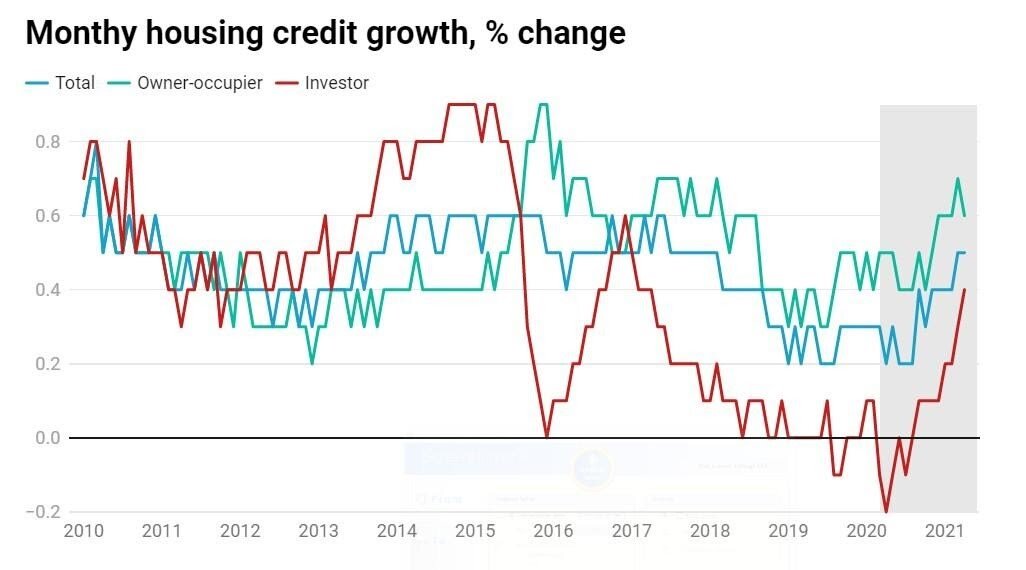

The graph below^^ compares the movement of credit over the years, and clearly shows rapid credit growth for investors in particular since the beginning of this year.

Prices have already risen by 16.1% nationally this year and the pace of growth over the past 12 months has been faster than anything we've seen since 2004.* This may make investors nervous that it's too late to capitalise.

However, many of the drivers of demand remain – low interest rates, low rental vacancies and low supply – which all bodes well for continued strong price growth. Most forecasters are predicting prices will continue to rise until the end of 2022.

In addition to this the increases in prices are being seen on valuations, making using equity better to purchase a new property.

The fact the RBA has repeatedly said interest rates will remain low for some time is also giving investors some comfort. In fact, as lenders are competing to attract investor clients, the majority of lenders have recently cut variable and short-term fixed rates for investors.

However, the window of opportunity may be closing. Property price growth has been trending lower since March, when it hit a high of 2.8%. Growth in July was 1.6%. In seasonally adjusted terms for investor housing, in June 2021, the value of new loan commitments in South Australia rose 11.6%

As can be seen from the graph above, investor credit growth is edging towards the same levels as 2017, when regulator APRA intervened and tightened lending requirements. Regulators are currently saying they are just keeping an eye on lending standards; however, it is possible they could step in and put a cap on investment lending. This could make borrowing more difficult for investors.**

If a property investment is on your radar, please talk to us as soon as possible to help you access a competitive investor rate and get your foot in the door before conditions change.

Contact our office today on 08 8418 2111 or email enquire@addept.com.au to schedule a meeting and determine your personal financial position in an investment scenario.

www.abs.gov.au^

www.abc.net.au ^^

www.realestate.com.au *

www.abc.net.au **